What is an Annuity? An annuity is a type of investment account typically used for retirement savings or to generate lifetime income payments in retirement. By definition, an annuity is a contract between you and a third party, usually an insurance company, whereby in exchange for making a lump sum payment (or by paying a monthly premium), the issuing insurance company provides some type of guarantee on your investment.

You can purchase an annuity outright or roll over money from an employer-sponsored retirement plan, such as

- 401(k),

- 403(b),

- or other profit sharing plan.

Rolling over your assets into an annuity offers you continued tax deferral, growth potential, protection from market downturns, guaranteed lifetime income, flexibility, and allows you to leave a legacy for your loved ones. BBX can assist you with identifying and purchasing the annuity that will best help you achieve your retirement goals.

Annuities for Individuals

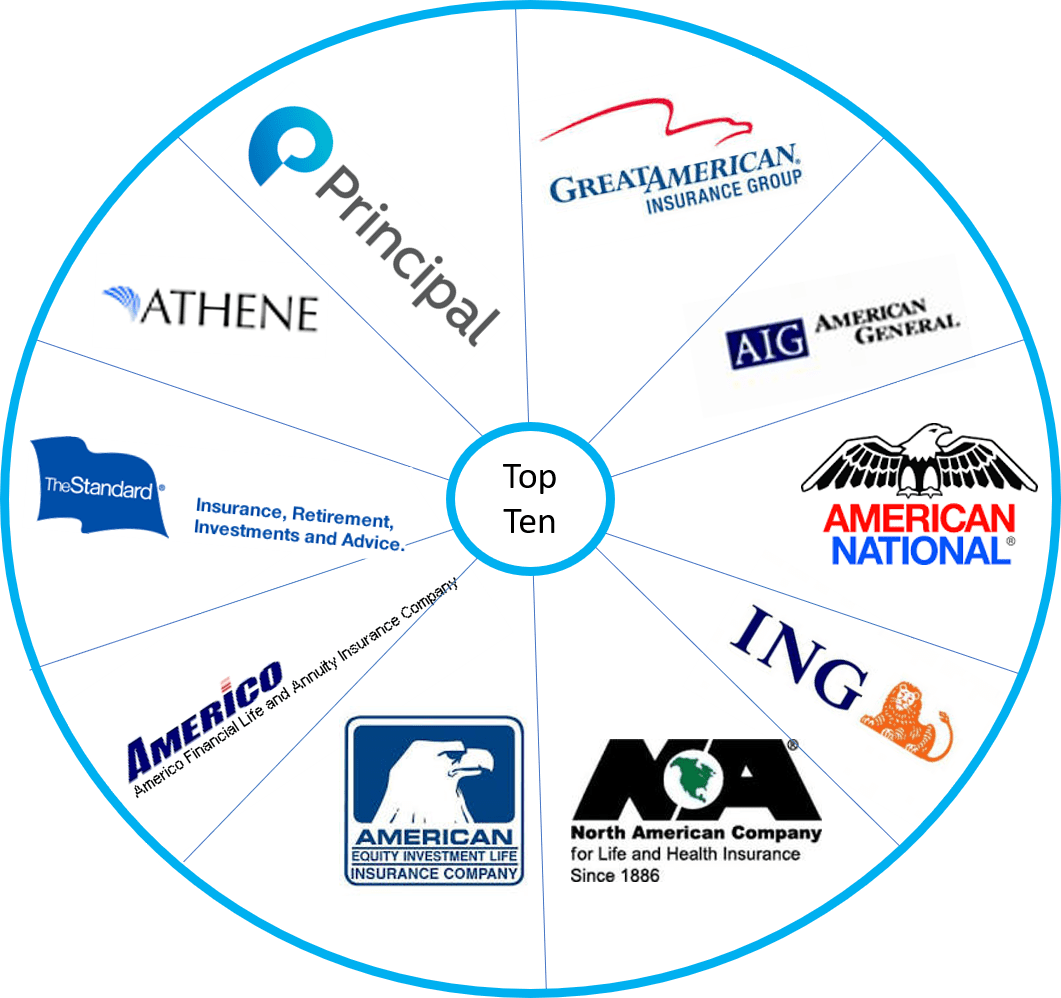

Our Top 10 Companies

Watch the video by Legacy below to discover an all-in-one strategy to for addressing three top retirement concerns:

- running out of money

- off-setting inflation

- paying for healthcare expenses